Online accessibility is more important than ever. Many people can’t or don’t want to travel from their homes to accomplish tasks, including accessing loans. For these people, and those who just want a simple and fast process, online loans are essential.

Many lenders, including ACE Cash Express, offer online options for a variety of loan types. As long as you have access to the internet and meet the requirements set by the lender, you can apply for an online loan in a fast and convenient way.

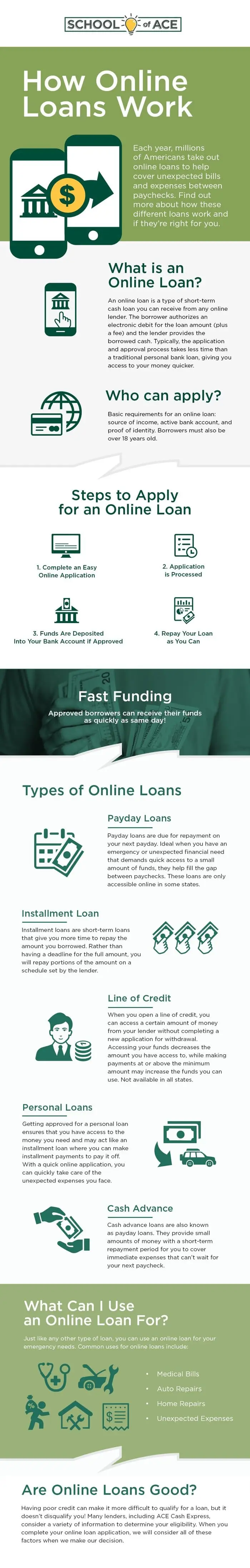

What is an Online Loan?

An online loan is a loan that you can apply for online. Rather than appearing in-person to request a loan, you can complete the entire process through the internet. Typically, the application and approval take less time than an in person personal loan, giving you access to your money quickly, if you are approved.

Since the entire process is online, however, you have to submit personal information over the web, something some people may not be comfortable with. That said, reputable lenders equip their websites with strong security to protect you and your private information.

Just because the process is digital does not mean you can’t get in touch with a representative who can answer your questions. Many lenders are happy to connect over the phone to provide the information you’re looking for.

How Online Loans Work

Online loans work much like traditional loans. First, you’ll need to find a lender that offers the kind of loan you need. Once you have found the right option, you can complete the online application available on the lender’s website. To apply, most lenders will ask for the following information:

- Email address

- Phone number

- Proof of a regular source of income, such as employment, disability, retirement or another approved option

- Social Security number or a tax ID

- Valid bank account info

- Other verification information might be requested.

Generally, you will get an instant answer about your application once you submit it. If approved, you will likely be able to access your money within hours or just a few days.

One of the greatest benefits of using online loans is the option to get all of the information you need before you commit to a lender. You can, for example, see the rates and amounts to find the best one for you. You are able to get loan approval amounts and see the fees before signing your loan agreement. With all this information at your fingertips, you can have confidence in the decision you make.

What Can I Use an Online Loan For?

Just like any other type of loan, you can use an online loan for your emergency needs. You can use the loan for emergency expenses such as a medical bill, a car repair, or whatever you may see fit. Use any loan money wisely and ensure you are able to pay back the loan with any accrued interest and fees. You can minimize your interest payments and maintain good standing with your lender by possibly making your payments early.

Types of Online Loans

There are numerous types of online loans. Technically, ‘online’ only refers to the application process, not the specifics of the loan itself. Use the information below to understand which short-term loans may be available, depending on your state. Armed with these details, you can then choose the option that is best for your circumstances.

Installment Loans

Short-term online installment loans are short-term loans that give you more time to repay the amount you borrowed. Rather than having a deadline for the full amount, you will repay portions of the amount on a schedule set by the lender. How many total payments and how long you have to repay them will vary depending on the frequency of your paychecks. These loans are only available online in some states.

Payday Loans

Payday loans, on the other hand, are due for repayment on your next payday. This option is ideal for situations that demand quick access to a small amount of funds. Online payday loans help fill the gaps between paychecks when you have an emergency or unexpected financial need. You can only access these loans online in some states.

Line of Credit

When you open a line of credit, you can access a certain amount of money from your lender without have to complete a new application for every withdrawal. Accessing your funds decreases the amount you have access to, while making payments at or above the minimum amount may increase the funds you can use. If you anticipate needing regular access to loaned funds, a line of credit may be the best option, depending on your state.

Personal Loans

Getting approved for a personal loan ensures that you have access to the money you need and may act like an installment loan where you can make installment payments to pay it off. With a quick online application, you can quickly take care of the unexpected expenses you face.

Cash Advance

Cash advance loans are also known as payday loans and provide small amounts of money with a short-term repayment period. You can use these funds to cover immediate expenses that can’t wait for your next paycheck.

Secured and Unsecured Loans

A secured loan requires some form of collateral to back the loan. If you don’t repay your loan as agreed, the lender may be able to seize this asset as an alternative to collecting any outstanding amount due. Unsecured loans, on the other hand, don’t include collateral. The amount you borrow and interest rates may vary depending on the type of loan you request. Your lender can help you determine which option is best for you.

Different Types of Lenders

Along with different types of loans, there are multiple types of lenders that offer online loans. Primarily, you will see two types of lenders for the types of loans we have been discussing: direct lenders and third-party lenders.

Direct Lenders

A direct lender is in charge of every part of the process. They set the rules, approve applications, and handle repayments. Since they have full control, they can make faster approval decisions and connect you with your money quicker. All of your information, communication, and payments will only go to this company.

Third-party lenders

A third-party lender, however will find a direct lender to offer the loan you need. They generally do not make any decisions about your approval or how much money you can borrow. Instead, they will pass your information and repayments to multiple lenders to facilitate the loan for you.

Online Loans for Bad Credit

Having poor credit can make it more difficult to qualify for a loan, but it may not disqualify you! Many lenders, including ACE Cash Express, consider a variety of information to determine your eligibility. When you complete your online loan application, they will consider all of these factors when making a decision.

FAQs

Still have questions? Read through our answers for frequently asked questions regarding online loans.

Can I get a loan if I already have one out?

We don’t recommend having multiple loans and specifically don’t suggest using one to pay off another loan. When added on top of the new loan’s fees, you could end up in deeper debt than when you started, with just as much trouble paying it all back. For more information, ask your lender for their policy.

How do I apply for an online loan?

You will need to complete the online application to see if you are eligible for the loan. Typical qualifications include:

- Name

- Proof of income

- Address

- Valid and active email

###

How long does it take for an online loan to be deposited?

It varies depending on company, but with ACE, you may be able to access your money the same day via in-store pickup or the next business day via ACH, if you are approved.1,2 You may be able to choose either direct deposit or in-store pickup (depending on your state), whichever is more convenient.

What is the best payday loan online?

The best online loans are the ones that meet your specific needs. Consider the lending requirements, what you need for the application, how much you can borrow, repayment period length, and how quickly you can access your funds. You should also find a reputable lender with good reviews and great customer service.

Online Loans Near Me

There can be loan options where you apply for the loan online and pick up the cash near you. It really depends on the lender and the locations they have close to you. Be sure to take that into consideration when you are applying for a loan. Ready to apply for an online loan? Find the ideal loan option or connect with a representative for more information.